Days Sales Outstanding (DSO) lies at the heart of effective accounts receivable management. In today’s fast-paced business environment, understanding and optimizing your DSO isn’t just about knowing the numbers – it’s about having the right tools to transform those insights into action. That’s where ÉquiSettle comes in, revolutionizing how businesses manage their collections process.

What is DSO?

Days Sales Outstanding (DSO) measures the average number of days it takes for a company to collect payment after a sale has been made. This crucial metric indicates the efficiency of your accounts receivable management and overall cash flow health. With ÉquiSettle’s advanced analytics dashboard, you can track this metric in real-time and receive actionable insights for improvement.

The Basic Formula

DSO is calculated using this formula:

Copied!DSO = (Accounts Receivable / Total Credit Sales) × Number of Days in Period

While this calculation is straightforward, ÉquiSettle’s analytics platform automatically tracks your DSO using the more accurate countback method, providing you with real-time insights and trends.

Understanding DSO Across Different Business Aspects

DSO in Accounting

From an accounting perspective, DSO reveals the efficiency of your accounts receivable management. ÉquiSettle enhances this by providing:

- Real-time DSO tracking

- Automated invoice processing

- Smart payment matching

- Customizable reporting dashboards

DSO in Finance

For financial management, DSO indicates your company’s ability to convert credit sales into cash. ÉquiSettle’s financial tools offer:

- Cash flow forecasting

- Payment trend analysis

- Risk assessment tools

- Working capital optimization

DSO in Business Strategy

As a business metric, DSO reflects your operational efficiency and customer relationship management. ÉquiSettle helps optimize both through:

- Customer payment behavior analysis

- Automated communication workflows

- Performance benchmarking

- Strategy optimization tools

Factors Affecting DSO and ÉquiSettle’s Solutions

1. Credit Terms

Your credit policies significantly impact DSO. ÉquiSettle helps optimize these through:

- Credit risk assessment tools

- Automated term management

- Customer payment history analysis

- Policy compliance monitoring

2. Customer Payment Behavior

Understanding and influencing payment patterns is crucial. ÉquiSettle provides:

- Payment behavior analytics

- Predictive payment modeling

- Custom reminder schedules

- Multi-channel communication tools

3. Industry Standards

Different industries have varying payment norms. ÉquiSettle offers:

- Industry benchmarking

- Sector-specific analytics

- Competitive analysis tools

- Best practice recommendations

4. Invoice Management

Efficient invoicing directly affects DSO. ÉquiSettle streamlines this with:

- Automated invoice generation

- Real-time tracking

- Dispute management

- Payment reconciliation

5. Collection Processes

Your collection strategy is key to DSO optimization. ÉquiSettle enhances this through:

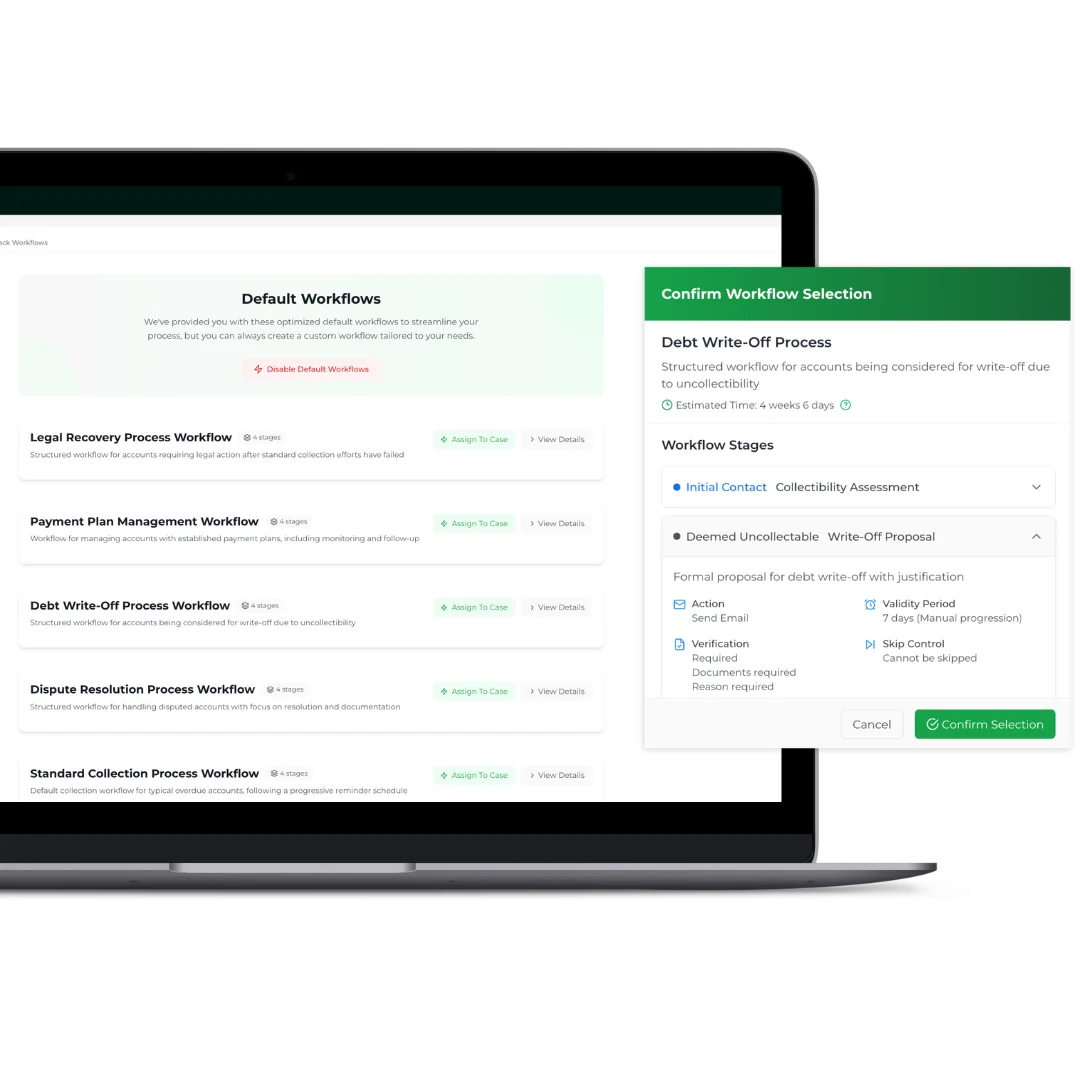

- Automated collection workflows

- Smart prioritization

- Performance analytics

- Success rate tracking

How to Interpret Your DSO with ÉquiSettle

Understanding the Numbers

ÉquiSettle’s analytics dashboard provides:

- Historical DSO trends

- Industry comparisons

- Peer benchmarking

- Performance insights

Setting Targets

Our platform helps you:

- Establish realistic goals

- Track progress

- Identify improvement opportunities

- Measure success

Industry-Specific DSO Benchmarks

Different industries have varying DSO standards. ÉquiSettle’s database provides up-to-date benchmarks for:

Manufacturing

- Median DSO: 56 days

- Top performers: 45 days

- ÉquiSettle optimization potential: 20-30%

Professional Services

- Median DSO: 45 days

- Top performers: 35 days

- ÉquiSettle optimization potential: 25-35%

Retail

- Median DSO: 30 days

- Top performers: 25 days

- ÉquiSettle optimization potential: 15-25%

How to Reduce Your DSO with ÉquiSettle

1. Automate Your Billing Process

ÉquiSettle provides:

- Automated invoice generation

- Smart payment tracking

- Customizable workflows

- Performance monitoring

2. Optimise Customer Communications

Our platform enables:

- Automated reminders

- Multi-channel outreach

- Personalized messaging

- Response tracking

3. Implement Early Payment Incentives

ÉquiSettle helps manage:

- Early payment discounts

- Loyalty programs

- Payment plans

- Success tracking

Beyond Traditional DSO Limitations

While DSO has some inherent limitations, ÉquiSettle helps overcome them:

Transaction Linking

- Automated payment matching

- Smart reconciliation

- Exception handling

- Audit trails

Dispute Management

- Automated dispute tracking

- Resolution workflows

- Impact analysis

- Performance monitoring

Invoice Weighting

- Smart prioritization

- Value-based analytics

- Risk assessment

- Collection optimization

Getting Started with DSO Optimization

1. Assess Your Current Position

Use ÉquiSettle to:

- Calculate your current DSO

- Compare against benchmarks

- Identify improvement areas

- Set realistic targets

2. Implement Optimization Strategies

Our platform helps:

- Automate key processes

- Optimize communications

- Track performance

- Adjust strategies

3. Monitor and Improve

ÉquiSettle provides:

- Real-time monitoring

- Performance analytics

- Improvement suggestions

- Success tracking

Conclusion

Mastering DSO is crucial for business success, and ÉquiSettle provides the tools and insights needed to optimize this vital metric. By combining automated processes, intelligent analytics, and industry-specific solutions, our platform helps businesses transform their accounts receivable management and improve cash flow efficiency.

Ready to transform your DSO management? Schedule a demo with ÉquiSettle today and discover how our platform can help optimize your collections process.

Download our free DSO calculator template and see how ÉquiSettle can help improve your metrics!

Leave a Reply