Checkout our LinkedIn for te latest updates: Équisettle

Any business that makes sales on credit understands that the account receivables are a major component of their balance sheet. Recording it efficiently is not only crucial to maintaining accurate financial statements but also essential for managing cash flow and assessing a business’s financial health.

However, a common bookkeeping question is whether accounts receivable should be recorded as a debit or a credit.

To answer this question, in this blog we will explore the role of accounts receivable and how they should be recorded on the balance sheet. Let’s start with the basics.

Understanding the Role of AR in Accounting

In simplest terms, accounts receivable refer to the money that a business is expected to receive from customers who have purchased goods or services on credit. This amount is recorded as an asset on the company’s balance sheet because it represents a future cash inflow.

In addition, accounts receivable can also be used to assess a company’s creditworthiness. In a survey of small business owners conducted by the Federal Reserve Bank of New York, 39% of respondents cited cash flow issues as a top challenge for their businesses. Lenders and investors may look at a company’s accounts receivable balance as an indicator of its ability to generate cash and manage its finances.

Overall, understanding the role of accounts receivable in accounting is crucial for any business owner or financial decision-maker. By properly tracking and managing accounts receivable balances, companies can improve their cash flow, maintain strong customer relationships, and meet their financial obligations in a timely manner.

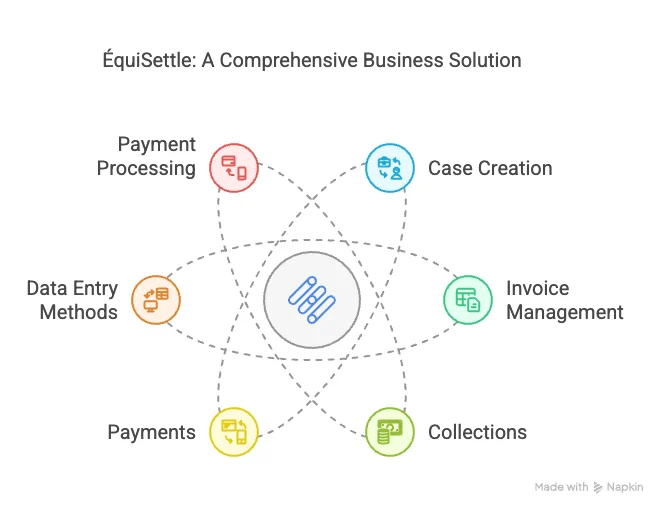

Learn More about EquiSettle’s Accounts Receivable Software

Achieve lower DSO, improved working capital, and enhanced productivity with our AI-powered accounts receivable platform that seamlessly integrates with modern ERPs.

AI Prioritized Worklist – Collections

Accelerate payment recovery from delinquent customers and boost cash flow through automated collection workflows.

AI Prioritized Worklist – Cash App

Achieve same day cash application with automated remittance aggregation.

AI Prioritized Worklist – Credit

Mitigate credit risk, reduce bad debt, and streamline customer onboarding with AI-powered insights.

AI Prioritized Worklist – Deductions

Reduce Revenue Leakage with AI Prediction models that identify valid and invalid deductions.

A Brief About the Account Receivable Process

The accounts receivable process cycle involves several steps that businesses must follow to ensure timely payments from their customers. These steps include:

- Invoicing: The first step in the accounts receivable process is to create and send an invoice to the customer. This invoice should include the details of the goods or services provided, the amount owed, and the payment terms.

- Payment terms: Clearly state the payment terms on the invoice, including the due date, payment method, and any applicable early payment discounts or late payment penalties.

- Payment follow-up: After sending the invoice, it’s important to follow up with the customer to ensure timely payment. This can be done through email, phone calls, or automated reminders.

- Payment receipt: Record the payment in the accounts receivable ledger and post it to the appropriate customer account once received.

- Reconciliation: Reconcile accounts receivable by comparing amounts received to amounts owed, identifying any discrepancies or overdue payments.

- Bad debt management: Implement a bad debt management plan to address situations where customers are unable to pay their debts, minimizing potential losses.

By following these steps, businesses can effectively manage their accounts receivable cycle and maintain a healthy cash flow. It’s important to have a clear understanding of your customers’ payment habits and establish a system for tracking and reconciling payments.

Is Accounts Receivable Debit or Credit?

Accounts receivable is money owed to a company by customers for goods or services delivered but not yet paid for. It’s recorded as a debit entry in accounting as it increases assets. When a sale is made on credit, accounts receivable is debited and sales revenue is credited.

One of the key functions of accounts receivable is to help companies manage their cash flow. By tracking the amount of money owed to the company, it allows companies to better manage their working capital and ensure that they have enough funds to operate their business. Let’s understand this better with the help of an AR entry on the balance sheet.

The Accounting Equation: Accounts Receivable on Balance Sheets

The accounting equation is the foundation of financial accounting that represents the relationship between a company’s assets, liabilities, and equity. Assets are things a company owns with value, liabilities are debts and obligations a company owes, and equity represents the ownership of the company.

Accounts Receivable as a Debit

Accounts receivable is recorded as an asset on a company’s balance sheet. It indicates money owed to the company, expected to be collected within a specific period, usually 30 to 90 days. Accounts receivable is listed as a current asset, meaning it is expected to be collected within the next year.

When recording accounts receivable journal entries, debits are always recorded under assets and placed on the left-hand side of the entry, while credits are recorded on the right. It’s important to ensure that your debits and credits always balance each other out.

For example, let’s say a company receives payment from a customer for goods or services they received. The bookkeeper would record the payment as a debit in the left-hand column under assets, while also recording a credit of the same amount in the right-hand column, assigned to revenue. This entry balances the books and reflects the increase in assets and revenue for the company.

Account Debit Credit Accounts Receivable – Molly Inc. $55,000 – Revenue – $55,000

Accounts Receivable as a Credit

While accounts receivable is typically recorded as a debit, there are times when credit balances can occur in the accounts receivable account. This happens when the amount of money owed to a company by its customers is less than the amount of money the company owes its customers.

A credit balance in accounts receivable can occur for several reasons, including:

- Overpayment by a customer

- Billing errors

- Prepayments by a customer

- Discounts applied

- Returns, and allowances after payment

Although it’s normal to have credit balances in accounts receivable, frequent occurrences can indicate issues with billing and collection processes. Let’s understand the concept of credit balance in accounts receivable in detail.

What Is a Credit Balance in AR, and What Does It Mean?

As mentioned above, a credit balance in accounts receivable (AR) occurs when a customer pays more than what they actually owe. For example, if a customer’s invoice was $800 but accidentally paid $900, the customer has an extra $100 with your company, which can be refunded or used for future purchases.

In other terms, a credit balance in accounts receivable indicates that the business owes money back to the customer. Businesses can manage this in the following ways:

- Refund the Customer: Process a refund to return the excess amount to the customer if they request it or if it’s their preference.

- Apply to Future Invoices: Use the credit balance to offset against future purchases or invoices from the same customer.

- Communicate with the Customer: Notify the customer of the credit balance and confirm their preference for a refund or application to future orders.

- Regular Review: Periodically review accounts with credit balances to ensure they are correctly managed and resolved in a timely manner.

- Adjust Records: Ensure your accounting records are updated accurately to reflect the credit balance and any actions taken, maintaining clear and precise financial statements.

If your company frequently encounters credit balances in AR, there can be underlying causes like inaccurate billing, unclear credit terms, lack of proper customer collaboration, and much more. To avoid this, you must ensure that you are on top of your accounts receivable management process.

5 Best Practices for Managing Your Accounts Receivable

Managing accounts receivable balances is crucial for maintaining a healthy cash flow and ensuring timely payments from customers. Here are some best practices for managing accounts receivable balances:

1. Establish clear credit terms with customers

Credit terms refer to the conditions under which a business extends credit to its customers. This includes details such as payment due date, early discounts, late payment charges, etc. It is important that businesses clearly define and communicate credit terms to the customer clearly from the outset to avoid any confusion and misunderstandings.

2. Prioritize customers dynamically for faster collections

To ensure timely payments, collectors need to prioritize customers based on various parameters such as aging analysis, payment behavior, credit risk class, and payment commitment analysis. By proactively monitoring these parameters and using an AI-based Collections system, collectors can dynamically prioritize their worklist based on predicted payment dates and customize collection strategies with AI recommendations.

3. Achieve same-day cash posting for better visibility

Same-day cash posting is a crucial focus area for cash application teams. By deprioritizing manual tasks such as remittance gathering and deduction coding, and using an automated cash application process, analysts can auto-match open invoices to incoming payments and achieve same-day, accurate cash posting. Using an AI-based Cash Application system can help resolve exceptions faster with intelligent recommendations.

4. Enhance customer experience with customized invoice delivery

To improve customer experience, invoicing teams should cater to customers’ invoicing or billing preferences and customize invoices based on their brand guidelines or preferences. Automation can help generate customized invoices and automate invoice delivery via email, fax, or A/P portals and accounting systems. This not only improves customer satisfaction but also streamlines the invoicing process, leading to faster payments and a healthier cash flow.

5. Mitigate risks by regularly reviewing at-risk customers

Credit teams need to constantly monitor the credit risk of their customer portfolios to mitigate risks and reduce bad debt. By increasing the frequency of credit risk evaluation and using real-time credit risk monitoring, credit analysts can track changes in customers’ credit risk and payment behaviors, revise credit limits, and rescore customers to mitigate portfolio risks in real time. This helps maintain a healthy cash flow and enables senior finance leaders to make informed decisions based on intuitive analytics and reporting dashboards.

Maximize Profitability with EquiSettle’s AI-Powered Credit Risk Management Software

Businesses need to have effective credit risk management strategies in place to maintain a healthy cash flow and ensure timely payments from customers. EquiSettle’s Credit Management Software leverages AI to provide real-time credit visibility and helps businesses manage their global portfolios through comprehensive workflows. It offers several features that enable businesses to mitigate risks and improve their cash flow:

Real-time Credit Risk Monitoring

With EquiSettle, businesses can receive real-time alerts for any changes in their customers’ credit profiles, enabling them to make data-driven credit decisions. The software integrates seamlessly with ERP systems, enabling businesses to start monitoring in just 30 days.

Configurable Scoring Models & Approval Workflows

EquiSettle’s software allows businesses to customize credit scoring based on geography, customer segments, business units, and other factors. This feature enables businesses to fast-track credit approvals through complex corporate hierarchies.

Highly Configurable Online Credit Application

EquiSettle’s software offers a highly configurable online credit application process that makes it easy for businesses to onboard new customers while minimizing risk. The software can automatically capture financials, personal guarantees, and check bank references, streamlining the onboarding process.

Automatically Extract Credit Data

EquiSettle’s software can automatically capture credit ratings, financials, and credit insurance information from more than 35+ global and local agencies. This feature reduces manual effort and improves data accuracy, enabling businesses to configure the auto-extracted data in their preferred currency.

AI-Based Blocked Order Management

EquiSettle’s software leverages AI to predict blocked orders based on customers’ credit limit utilization and payment history. The software can recommend release or partial payment options for faster credit decisions, improving cash flow and reducing the risk of disputes.

Seamless Integration with Collections, Payments & Deductions

EquiSettle’s software seamlessly integrates with other functions such as collections, payments, and deductions, providing businesses with a comprehensive view of their accounts receivable processes. This feature enables businesses to share credit scores and risk analysis with collectors, review collectible amounts to calculate adjusted credit exposure, and dynamically update credit exposure leveraging payment and dispute information.

Conclusion

Understanding whether accounts receivable is a debit or credit is fundamental to proper accounting practices. As we’ve explored, accounts receivable is primarily recorded as a debit because it represents an asset—money that customers owe to your business. However, in certain circumstances like overpayments or returns, credit balances can occur.

Proper management of accounts receivable is crucial for maintaining healthy cash flow and financial stability. By implementing the best practices outlined in this article and leveraging modern solutions like EquiSettle’s AI-powered accounts receivable platform, businesses can streamline their AR processes, reduce DSO, and improve overall financial performance.

FAQs

Is accounts receivable a debit or credit in the balance sheet?

Accounts receivable is recorded as a debit on the balance sheet because it represents an asset—money that is owed to the company by its customers. When a sale is made on credit, accounts receivable is debited and sales revenue is credited.

What are the normal balances of accounts receivable?

The normal balance for accounts receivable is a debit balance, indicating money owed to the company by customers. However, credit balances can occur in specific situations such as customer overpayments or returns.

How does accounts receivable affect cash flow?

Accounts receivable directly impacts cash flow as it represents money that has been earned but not yet received. Higher accounts receivable can indicate strong sales but may also signal collection issues. Efficient management of accounts receivable helps ensure steady cash flow by converting these assets into cash more quickly.

What happens when an accounts receivable is paid?

When an accounts receivable is paid, the accountant debits the cash account (increasing it) and credits the accounts receivable account (decreasing it). This transaction moves the value from one asset account (accounts receivable) to another asset account (cash).

How can I reduce my DSO (Days Sales Outstanding)?

To reduce DSO, consider implementing clear payment terms, offering early payment incentives, using automated collection systems, regularly reviewing aging reports, and improving invoice accuracy. EquiSettle’s AI-powered solutions can help automate and optimize these processes for better results.

What’s the difference between accounts receivable and accounts payable?

Accounts receivable represents money owed to your company by customers (an asset), while accounts payable represents money your company owes to vendors or suppliers (a liability). Accounts receivable has a normal debit balance, while accounts payable has a normal credit balance.

Book a Call with one our experts: www.equisettle.co.uk/book

Leave a Reply