EQS Marketing Team

Author: EQS Marketing Team

-

Understanding if Accounts Receivable is Debit or Credit?

Checkout our LinkedIn for te latest updates: Équisettle Any business that makes sales on credit understands that the account receivables are a major component of their balance sheet. Recording it efficiently is not only crucial to maintaining accurate financial statements but also essential for managing cash flow and assessing a business’s financial health. However, a…

-

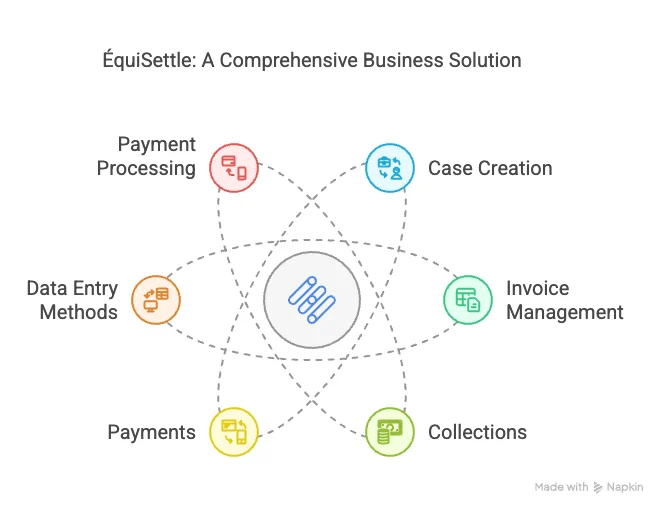

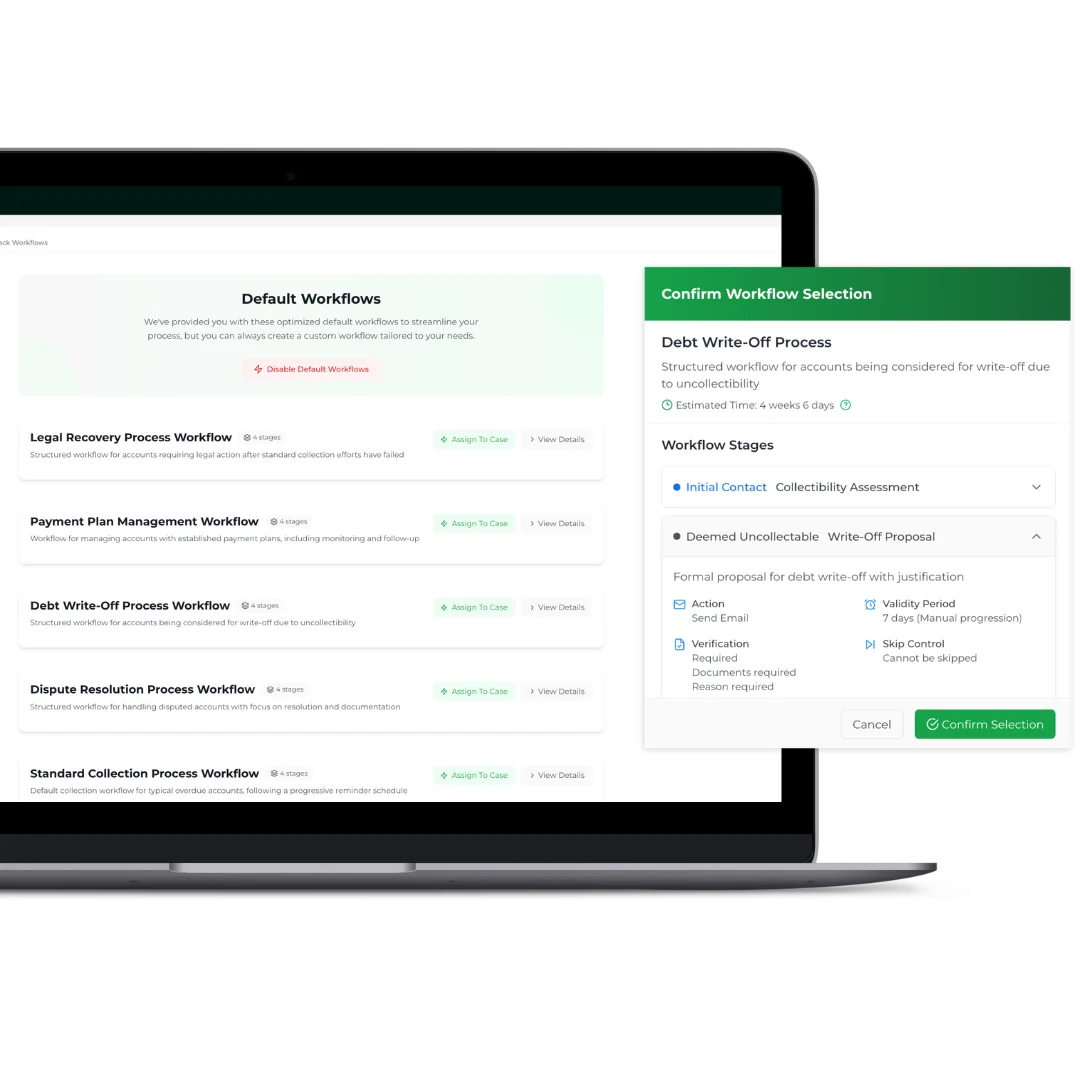

Choosing the best Business Management Software

Picking the right business management software is key to keeping things running smoothly and growing efficiently. Two of the most popular options are Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM). While both help businesses stay organized, they focus on different areas. This article breaks down their differences, the benefits of each, and how…

-

Get 60 days of fee free transactions when you sign up for Équisettle

Details of the offer: Promotion To welcome you to ÉquiSettle, we are giving you 60 days without transaction fees (the “Promotion”)! You will not be charged any ÉquiSettle transaction fees for transactions successfully processed during the Promotion Period*. *Up to a total transaction volume limit for the region you are located in: United States: $10,000…